Mail : shahbaz@eliteconsultingsllc.com Call Us : +971 58 827 3634

Mail : shahbaz@eliteconsultingsllc.com Call Us : +971 58 827 3634

Stay ahead of Dubai’s VAT regulations with our tailored strategies. Reduce tax burdens, avoid penalties, and optimize financial growth with trusted professionals by your side.

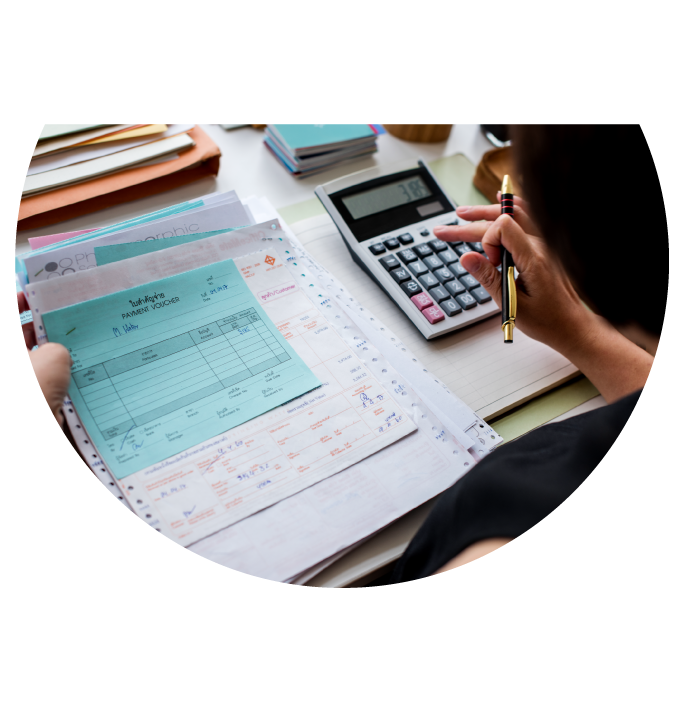

We follow a structured approach to handle VAT registration, compliance, and optimization. From documentation to expert guidance, every step is designed for accuracy and efficiency.

Hassle-free VAT registration and deregistration to keep your business compliant with Dubai’s tax laws.

Timely and accurate VAT return submissions to prevent penalties and ensure smooth operations.

In-depth compliance checks to identify risks and maintain adherence to tax regulations.

Expert assistance in reclaiming eligible VAT refunds efficiently and maximizing returns.

Comprehensive support during tax audits to ensure compliance and minimize liabilities.

Strategic insights to assess VAT implications and optimize tax planning for your business.

We deliver tailored VAT strategies to ensure compliance, minimize tax liabilities, and enhance financial efficiency. Our dedicated professionals simplify the process for businesses of all sizes.

Effortlessly navigate Dubai’s tax landscape with structured VAT solutions. Optimize processes and ensure compliance with precision-driven strategies tailored for business growth. Leverage industry expertise for tax efficiency while mitigating risks effectively.

Dynamically implement VAT compliance frameworks for accurate filings and optimized returns. Strategically align financial structures with evolving regulations to streamline operations and ensure transparency.

Proactively manage VAT registration, return filings, and compliance reviews with expert guidance. Enhance financial efficiency while reducing tax liabilities through structured advisory solutions.

Elevate your business with best-in-class VAT services, ensuring smooth audits and hassle-free financial management. Efficiently handle VAT refunds, impact assessments, and risk mitigation with trusted expertise.

Effectively streamline tax obligations with structured VAT registration and compliance solutions.

Optimize tax efficiency and ensure smooth regulatory adherence with expert VAT strategies.

Whether you're restructuring, expanding, or enhancing governance—we’re here to guide every step.

You must apply through the Federal Tax Authority (FTA) portal, providing business details, financial records, and supporting documents to complete the registration.

VAT returns are filed quarterly or monthly, depending on your business category. The due date is the 28th of the month following the tax period.

Non-compliance results in penalties, fines, and possible legal action. Ensuring timely registration, accurate filings, and adherence to VAT laws prevents unnecessary charges.

Businesses incurring more input VAT than output VAT can apply for refunds via the FTA portal, subject to eligibility and verification.